When a French person buys a pack of red or other cigarettes, many ask themselves: where does the money go? Who wins what ? Is it the manufacturer, the tobacconist or the State? And how much does each of them actually pay – in euros, in centimes? This article details the breakdown of the price of a pack of cigarettes in France, based on reliable public data and analyses.

Package price: a starting point

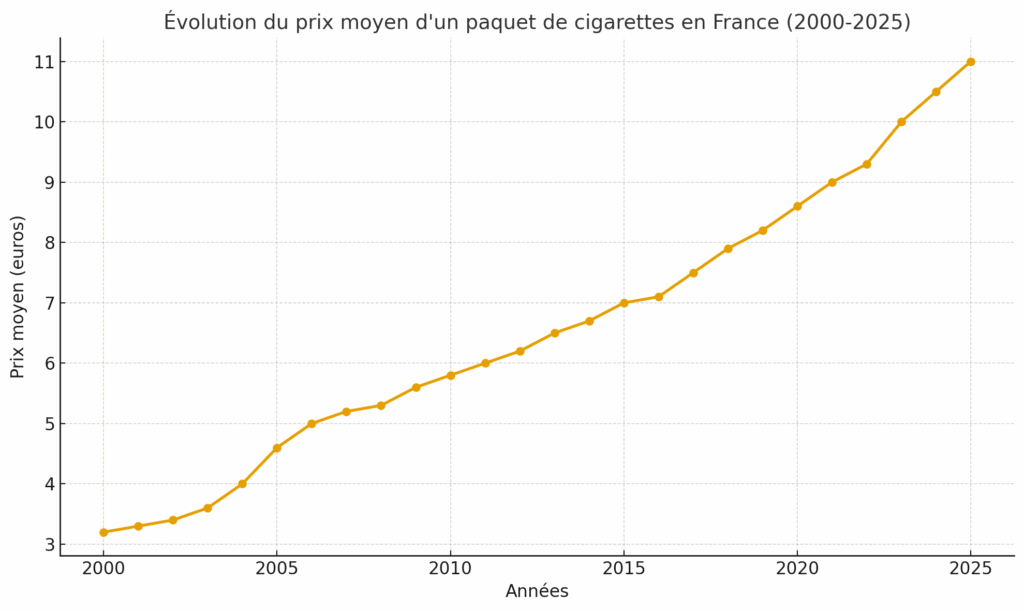

In France, a pack of cigarettes (often a “red” pack, a well-known brand such as Marlboro or others) typically sells for between 6.50 and 11 euros, depending on the brand, inflation, taxation and regular tax increases.

But of this final price, only a small part goes to the manufacturer, another to the tobacconist, while the bulk is made up of taxes and fiscal contributions.

According to a study reported by Europe 1, on a pack sold for around €7, 80.05% of the price goes to the State. This means that the State collects around €5.60 on this €7 packet. As for the

These figures are indicative, but fairly representative of the tax authorities’ report on cigarettes in France.

Industrial part: manufacture, transport, market

The cigarette manufacturer (Philip Morris, Imperial Brands, British American Tobacco, etc.) takes care of :

- manufacturing (tobacco leaves, rolling papers, filters, packaging)

- transport costs to warehouses or distributors

- marketing and advertising costs (within legal limits)

- industrial margin, i.e. the manufacturer’s gross profit

Estimates indicate that this industrial share (in our example of the €7 pack) represents around €0.80, or around 11-12% of the final price.

However, this overall margin includes the costs of production, logistics, discounts and negotiations with distributors (wholesale), and corporate structure (research, R&D, legal campaigns). Manufacturers don’t just “profit” from this margin: they also incur substantial fixed costs.

The tobacconist’s share: the small link in the chain

The tobacconist, or tobacconist‘s, is the person who sells the packet to the final consumer. His remuneration is in the form of a negotiated discount or commission, governed by regulations.

In our example, on the €7 package, he receives around €0.60, or 8.5% of the total price.

Some articles mention that this percentage varies around 8%, depending on net margins after discounts, local taxes, operating costs, etc.

What you need to understand: the tobacconist does not set the price of the packet. He receives a

State share: the “big winner” in taxation

The State, via customs, VAT and domestic consumption tax (excise duty), is the major beneficiary in the sale of a packet. In the example of the €7 packet, the State collects around €5.60, or 80% of the final price.

These tax revenues are used to finance social security, health insurance, public health initiatives and so on.

In a more recent context and according to other sources, for a €11.50 packet, the State would receive €9.50 in taxes, combining VAT, excise and other indirect duties.

Tobacco taxation accounts for a massive proportion of the price of cigarettes. It is an instrument used as a health tool (to discourage consumption), but also as a source of revenue for public accounts.

The dynamics of price rises, parallel markets and contraband

Every time the state raises taxes or the price of a packet rises, a larger proportion goes to the state – but the tobacconist doesn’t earn proportionally much more, as his commission remains fixed or limited. This creates an imbalance: most of the tax gain goes to the state, while the tobacconist is often “squeezed” between rising operating costs and falling sales.

This pressure creates a parallel market, with contraband and illegally imported cigarette packs gaining ground. A “grey” or “parallel” pack sometimes escapes much of the tax, making the price differential a strong incentive for certain smokers or illegal retailers.

Smuggling is therefore a partial response to a taxation model deemed too burdensome – but it undermines legal sales, government revenues and legitimate tobacconists.

Breakdown in a nutshell (simplified model)

| Actor | Approximate amount | Price share (%) |

|---|---|---|

| State (taxes, VAT) | ~ €5.60 on €7 | ~ 80 % |

| Industrial / manufacturer | ~ 0,80 € | ~ 11-12 % |

| tobacconist / salesman | ~ 0,60 € | ~ 8,5 % |

This model is indicative, but it highlights theoverwhelming tax dominance of cigarette prices in France.

Why is this distribution problematic?

- Disincentives for tobacconists: their low remuneration makes them vulnerable, particularly in the face of rising fixed costs.

- Erosion of the legal network: when a tobacconist disappears, parallel trade often takes his place.

- Burden on the consumer/smoker: most of the price paid is linked to taxation, not to high production costs.

- Ethical and social issues: the State collects a lot of money on a product that is harmful to public health. This paradox fuels debate about the role of tobacco in public revenues.

Remember: a reflex to better understand the package

When a French person buys a pack of cigarettes (whether Marlboro or another red brand), a tax trick is played out:

- TheState captures most of the revenue through taxes (VAT, excise duties).

- Themanufacturer pockets a modest margin after expenses.

- The tobacconist, despite direct contact with the customer, takes only a small share – and often suffers from the drop in consumption.

This reality begs the question: is it fair for the State to profit so much from a product that it is otherwise struggling to reduce?

MyLaserTabac: the gentle and effective anti-smoking laser method

Faced with the rising cost of tobacco, successive tax hikes and the impact of the price of a pack of cigarettes in France, more and more smokers are looking for natural, sustainable solutions to stop smoking. With this in mind, MyLaserTabac has established itself as a benchmark in smoking cessation using auricular laser stimulation.

Inspired by the principles of reflexology and alternative medicine, the MyLaserTabac method involves stimulating specific points on the ear with a gentle, painless laser. This technique aims to rebalance the nervous system, reduce nicotine cravings and ease withdrawal symptoms from the very first session.

Unlike nicotine substitutes or drug treatments, the MyLaserTabac anti-smoking laserintroduces no chemicals into the body. It works naturally by promoting the release of endorphins, the feel-good hormones that help relieve the tension associated with quitting smoking.

The results observed are particularly encouraging: many customers report a clear reduction in their cravings after just one session, with personalized follow-up to consolidate the effects over time. In addition, MyLaserTabac practitioners offer comprehensive support in managing stress, weight and withdrawal-related compulsions.

MyLaserTabac goes beyond simply quitting smoking to help you find a lasting balance, regain self-confidence and improve your overall health. It’s a modern, gentle and effective solution for definitively turning the page on smoking, while freeing you from the constraints of nicotine.